- As governments and international organizations recognize that the global order is becoming fragmented, creating a “Chief Geopolitical Officer” (CGO) position has become an urgent priority for companies.

- The CGO ‘s role is to integrate advanced geopolitical insight into core business decision-making.

- A three-point implementation framework will maximize the opportunities created by this role.

The UK Cabinet Office has published its first Chronic Risks Analysis, a comprehensive forecast of long-term, trickling “chronic risks” for UK businesses and policy leaders. The structural risks identified in the report span security, technology, and especially geopolitics. This marks the first time a major G7 economy has made it clear to its business and policy communities that global instability and the breakdown of the old international order are now risks to all businesses, not just a few large ones, and that they must actively prepare for them.

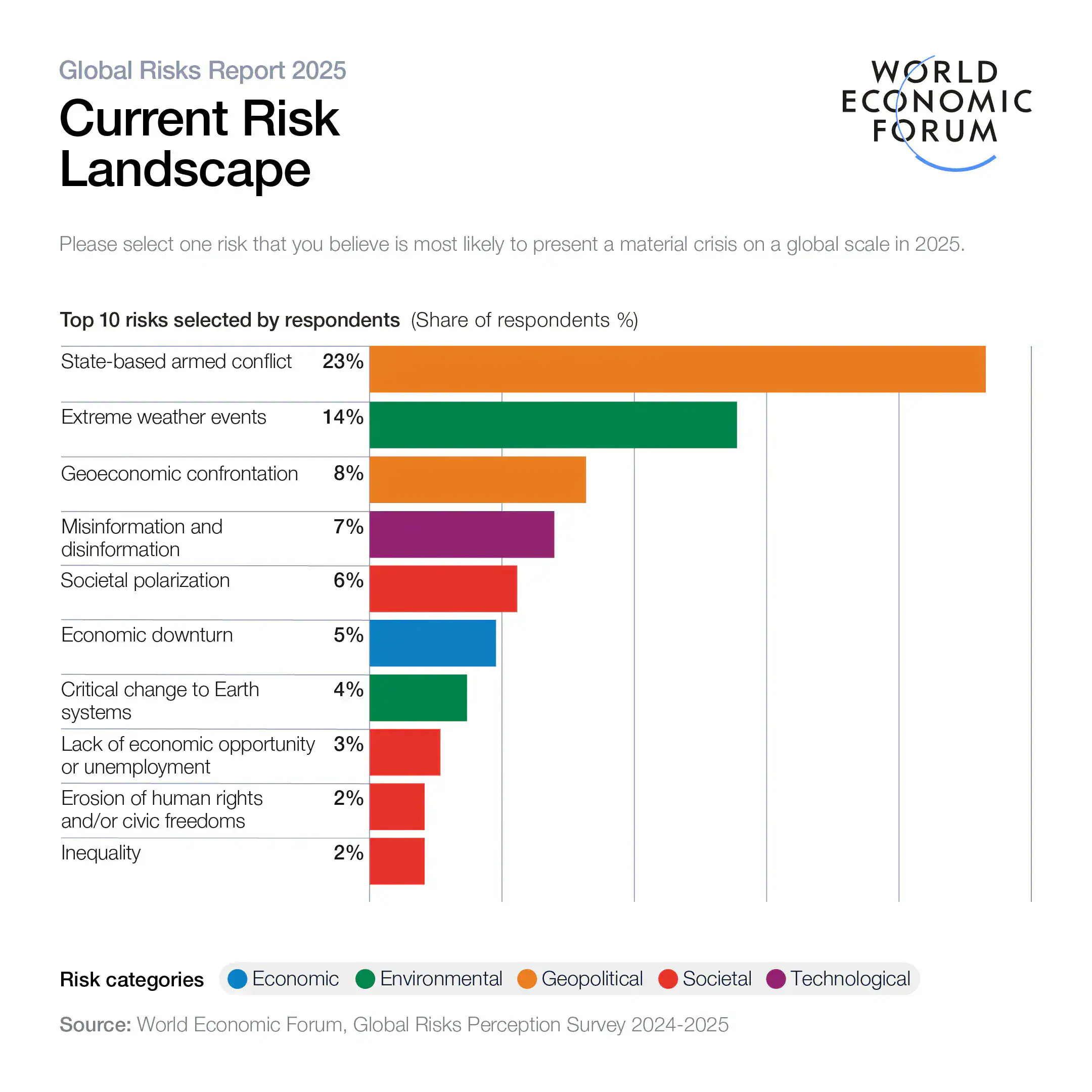

This unprecedented guidance is also in line with the World Economic Forum’s Global Risks Report, which, in its 20th edition, revealed that leaders are deeply concerned about the threats to stability and growth posed by a complex web of geopolitical, environmental, social, and technological challenges that are deepening global divisions. The 2025 report is truly prescient, as geopolitical risks are already manifesting in many areas, including trade wars, cyber conflicts, and even actual military conflicts .

With governments and even international organizations calling on companies to be vigilant about geopolitical risks, traditional international response frameworks are no longer sufficient for companies. The solution is not to improve relations with governments or strengthen risk management, but to appoint an entirely new executive role: the Chief Geopolitical Officer (CGO).

While the traditional risk management paradigm is based on the assumption that a stable, rules-based international system allows companies to operate within a predictable and investable framework, the Geopolitical Risks on Trade (GPRT) Index is projected to surge by approximately 30% between 2020 and 2024 compared to the previous 20 years, while the Global Supply Chain Pressure Index (GSCPI) has nearly tripled over the same period.

As a result, financial and operationally focused Chief Risk Officers (CROs) and government affairs teams responsible for compliance and policy affairs are ill-equipped to address the current environment of rising geopolitical tensions. These risks range from policy fragmentation and digital threats to financial warfare. Issues that were once peripheral to business strategy now pose significant financial, competitive, and existential risks. Specifically, they include:

- Regulatory diversity. Conflicting national policies can make compliance impossible: The TikTok app has been forced to sell its business in the US while operating freely in Europe, and its parent company, ByteDance, has been forced to split up its global operations.

- Military action. Following the invasion of Ukraine in February 2022, Russian foreign companies withdrew from the country, suffering losses of more than $170 billion, including British Petroleum (BP), which recorded a loss of $25.5 billion.

- Cybersecurity. Poorly regulated ” digital safe havens ” are emblematic of the lack of international cooperation. These areas serve as bases for online criminal gangs, enabling them to target and extort businesses. As a result, companies suffer severe financial damage and, in some cases, are driven to bankruptcy. Furthermore, in some cases, countries, such as Costa Rica, have been forced to declare a state of emergency.

- Economic conflict. Sanctions, tariffs, and export controls have become commonplace and can be very costly for individual companies. US sanctions are estimated to cost Huawei $30 billion a year in smartphone sales alone.

Chief geopolitical officers must consider ever-increasing global risks. Image: World Economic Forum

Responding quickly to geopolitical risks

Business restructuring in light of geopolitical turmoil is accelerating among companies. According to McKinsey, Russell Reynolds, and others, major companies have created new positions to oversee government relations departments and established geopolitical intelligence departments. Furthermore, since President Trump’s inauguration, Fortune 500 companies have also accelerated the hiring of diplomacy and geopolitics experts into senior positions.

Meta’s ” Vice President of Global Affairs, ” a role most recently held by former UK Deputy Prime Minister Nick Clegg, has existed at the company for more than a decade. His experience was needed as the tech giant needed to comply with European privacy regulations, US content moderation requirements, and navigate the complex challenges of expanding into diverse markets.

This is a pattern we’re seeing in other specialized C-suite roles: When environmental issues emerged as a business risk, the ” Chief Sustainability Officer” (CSO) was born, and when cyber threats rose to the C-suite’s priority list, the ” Chief Information Security Officer” (CISO) emerged from the IT department. Similar to these precedents, the CGO represents the elevation of geopolitical risk from a once-peripheral issue to a business imperative requiring dedicated C-suite leadership.

The CGO is not an elevated position from the head of government relations. It is a strategic position that integrates deep geopolitical insight directly into core business decision-making. This role goes beyond traditional lobbying and is responsible for developing strategies to act proactively in the global political landscape. Duties include:

- Intelligence and Forecasting. Monitor global political developments and conduct scenario planning to anticipate the impact on operations, supply chains, market access, and strategic partnerships, from economic tensions to regional conflicts.

- Stakeholder engagement: We strategically manage complex relationships with governments, regulators, and international organizations with competing interests and policies, and support decision-making to incorporate geopolitical risks into market strategies and trade policies.

- Crisis response. Enable your organization to act with agility in volatile environments by being prepared to respond quickly and decisively to unexpected geopolitical events that impact business operations, supply chains, or reputation.

Introducing a Chief Geopolitical Officer

Implementing a Chief Geopolitical Officer goes beyond managing geopolitical risks to creating and maximizing strategic opportunities. Done properly, this can lead to substantial value creation. Preparing for geopolitical change can unlock opportunities to improve cost and capital efficiency through shifting trade routes, new areas of organic growth, or restructuring global operations.

For example, while other Western automakers were shut out of the Chinese market, US-based Tesla’s Shanghai Gigafactory became the world’s largest vehicle production facility, accounting for more than 40% of global shipments. Similarly, Apple increased iPhone production by 50% year-on-year by diversifying its supply chain to India, generating billions of dollars in new revenue.

A structured framework is essential for businesses to proactively address geopolitical risk:

- 1. Audit current geopolitical risk exposure. First, conduct a comprehensive internal audit, including detailed mapping of all operations, supply chains, and revenue streams in the identified geopolitical risk regions, while also identifying regulatory dependencies and compliance requirements in various jurisdictions. Finally, evaluate current stakeholder relationships, identify potential conflicts of interest, and identify areas of vulnerability.

- 2. Build a geopolitical intelligence capability. Establishing a robust intelligence capability is essential. Assemble cross-functional teams, from R&D to sales, that can effectively connect geopolitical analysis to specific business functions. Also, develop sophisticated scenario-planning frameworks and stress-testing protocols to prepare for various geopolitical futures. In particular, integrate geopolitical risk assessments into existing business continuity plans.

- 3. Elevate geopolitical risk to the strategic level. The final step is to integrate geopolitical risk into the highest levels of the organization’s agenda. This can involve expanding the responsibilities of existing government relations functions, but more effectively, it can involve creating a dedicated senior position—a “Chief Geopolitical Officer” (CGO). This position should act as a central hub, working closely with senior management to ensure a holistic view and alignment of risk management and business planning.

As the world becomes more multipolar and fragmented, the “Chief Geopolitical Officer (CGO)” will no longer be a novel concept but will evolve into an essential C-suite position. Companies that proactively incorporate advanced geopolitical intelligence into their strategic DNA will be able to not only survive but also achieve sustainable growth in these turbulent times. In an era where a single decision can impact decades of value creation or stifle decades of growth, the Chief Geopolitical Officer will no longer be an endeavor that companies can afford, but a necessity.