- As insurance evolves, embedded insurance, which offers convenient coverage, could account for one-third of insurance products by 2028.

- The insurance industry sells itself on “trust,” but surveys show that young people do not trust insurance products.

- The real challenge is not growth, but whether new insurance models can close the “protection gap” and regain the trust of younger generations who have drifted away.

Insurance policyholders pay large amounts of insurance premiums every year, hoping that an unexpected event will never occur that requires them to use their insurance. However, when they do need to make a claim, they are often confused by complex terms and conditions and fine print.

The insurance industry was created to protect people and provide peace of mind, but legal complexities, hidden exclusions, and profit-driven incentive structures have made it more important to protect the financial foundations of companies than to protect customers. Furthermore, true customer-centric innovation and overall evolution of the insurance industry have been largely absent for many years.

At the heart of this transformation is a concept called “embedded insurance,” which means that insurance is built into the products and services people use, rather than going directly through an insurance company or agent.

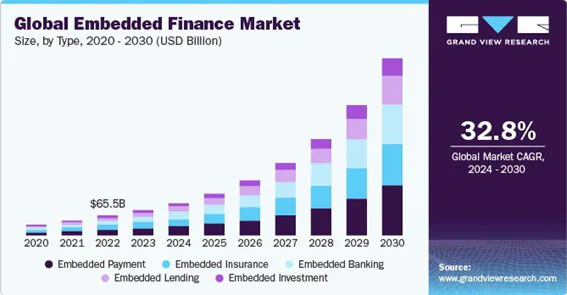

According to the Boston Consulting Group , embedded insurance premiums are expected to grow from $13 billion to over $70 billion by 2030. This is not just growth, it’s a transformation that will redefine the industry.

Various companies, including major brands, are making insurance products more accessible and integrating them into the purchasing process.

Airbnb’s AirCover automatically provides landlords with up to $3 million in liability and damage protection with every reservation, built into the booking flow with no additional sign-up or separate agreement required.

Avios Wanda is a travel insurance that can be seamlessly added at checkout when booking flights or hotels. Fully integrated into the booking process and easily managed through the app, it makes insurance part of the travel experience, not an afterthought.

Available when you buy an iPhone, Mac or iPad online or in-store, AppleCare is built-in insurance for your device that covers accidental damage, repairs and, in some areas, theft and loss.

“

Ultimately, the question is not whether embedded insurance will grow, but whether it can solve existing challenges.

”

Why Embedded Insurance is on the Rise

Embedded insurance is on the rise now because of the inescapable fact that the world is living in an era of a widening “protection gap” – the difference between the protection or benefits insured and the protection or benefits actually needed.

According to investment firm FinTech Ventures , this gap doubled between 2000 and 2020, driven by urbanization, climate change shocks and a chronic lack of real innovation. Millions of people are currently underinsured or paying excessive premiums without fully understanding what they are covered for.

What is particularly serious is that the insurance industry is not gaining sufficient support from the younger generation, who are the most important demographic to reach.

According to a 2023 survey by LIMRA, an insurance and related financial services industry association , only 48% of millennials and 40% of Gen Z have life insurance, with roughly half feeling that their coverage is insufficient. Furthermore, many young people cited high premiums, lack of transparency in product details, and distrust of the industry as reasons for not purchasing insurance. This is not simply a sales challenge, but a structural crisis between generations. If the next generation turns away from insurance altogether, the traditional insurance model itself could collapse.

Factors that will eliminate the “protection gap”

Embedded Insurance 2.0, the next generation of embedded insurance, may be the industry’s biggest opportunity to turn the narrative around. But embeddedness alone isn’t enough, because the real value lies in trust. EY estimates that by 2028, more than 30% of insurance transactions will be conducted through embedded channels. But the numbers mean nothing if people don’t trust the products they buy.

Real-time, data-driven personalization is key, especially for younger generations who expect everything to be customized and delivered instantly. Leveraging high-quality data allows for more personalized insurance experiences.

According to an Accenture survey , 60% of consumers say they would be willing to share sensitive personal data in order to get fairer pricing and coverage that fits their lifestyle.

However, trust isn’t built by the amount of data, but by how that data is used. Digital wallets are also expected to help bridge the gap in coverage. For example, platforms like Rehuman use generative AI to provide users with easy-to-understand insurance information without technical jargon, visualizing what coverage they have and where gaps exist.

More importantly, embedded insurance doesn’t work in isolation, but delivers its greatest value through collaboration: traditional insurers provide underwriting expertise, insurtechs provide technological innovation, and consumer brands provide everyday relationships and data touchpoints that traditional insurers could never achieve alone.

When these partnerships work well, they not only expand reach, but also provide deeper insights and offer compelling products that seamlessly integrate into people’s lives.

The importance of insurance

EY predicts that embedded transactions will soon account for around one-third of the total market , but these numbers will be meaningless unless the experience delivers real value.

Ultimately, the question is not whether embedded insurance will grow, but whether it can solve existing challenges: Can it close the “protection gap,” can it rehumanize insurance, and most importantly, can it win back a disillusioned generation?

The choice is clear: transform or disrupt. The wave of new technology is already here. The future of insurance will be shaped by brands that engage with customers transparently, collaborate with innovators, use data responsibly, and put people at the heart of everything, not just profits.